This also implies that you need spend less than $5,000-10,000 throughout each offer, in order to earn a profit. Considering that this type of real estate investing doesn't need any money below the wholesaler, no credit or loans are required and the wholesaler can focus exclusively on discovering a money purchaser. Needs to the deal not go their method, they will just run out pocket on their marketing expenses.

Wholesale property is when an investor gets in a contract with a seller and after that assigns the contract to a purchaser at a greater cost. The investor is then able to keep the difference as revenue. Wholesaling property can just take place when home is being sold under its market price. This is typically the case with foreclosures, but not constantly. The secret is to find a seller that is encouraged to offer their home quickly. The main reasons for a residential or commercial property entering into foreclosure are typically financial hardships or extreme repair work the owner is not ready to deal with any longer.

It is essential to know that investor may likewise work as a wholesaler and tend to find these chances through advertisements, contractors, and networking. Once they find a preferable property, they reach the inspired seller and participate in an agreement as the purchaser. If they can get the residential or commercial property prior to it is foreclosed on they can ensure it remains in their hands and the homeowner gets to entrust to cash in their pocket so it is a better situation than a bidding war and the resident leaving with nothing. When the wholesaler cuts the deal with the seller, the next action is to line up a financier or DIYer that does not mind some additional work.

Their goal is to get a brand-new purchaser to purchase the residential or commercial property quickly and preferably prior to the contract closes. When the deal closes, the preliminary financier (the real estate wholesler) gathers the distinction in between the agreed rates as profit. Other times they may sit on the property and take it as a net loss for their taxes since they know the residential or commercial property value is going to increase. One major difference between being a realty wholesaler and a financier is that a wholesaler rarely really sells the house. Instead, they are trying to offer the rights to buy the residential or commercial property and broker a deal.

Although it is comparable, the wholesaler doesn't invest any money into the home. Normally, the cash invested (if any) is into down payment payments on the residential or commercial property. Wholesale transactions also occur quicker than flipping. On the slower side a wholesaler will require a week or more to find a purchaser, however oftentimes, it can happen in a day or more. The reason is they are professionals at determining flip worthwhile homes and most likely have a database of financiers searching for offers (Which combines google maps with real estate data). The amount of cash wholesalers can make will depend on the difference in agreed rates. It may only be a couple of thousand dollars, but it can be much more.

If you can't move the residential or commercial property rapidly enough, you may wind up needing to purchase it which can consume your capital rapidly. How to become a real estate agent in ny. There are a couple of steps to getting included with wholesaling. Initially, an investor requires to study a neighborhood or area and understand the residential or commercial property worths in the area. They ought to likewise discover the ins and outs of the local marketplace so they know where to look when residential or commercial properties go on sale and where to discover financiers or buyers. Networking is likewise vital. Prior to investing, one need to have connections to other investors who have an interest in acquiring homes. Prior to beginning, a method for each property type need to be developed in order to guarantee they can discover buyers to designate agreements to as quickly as possible.

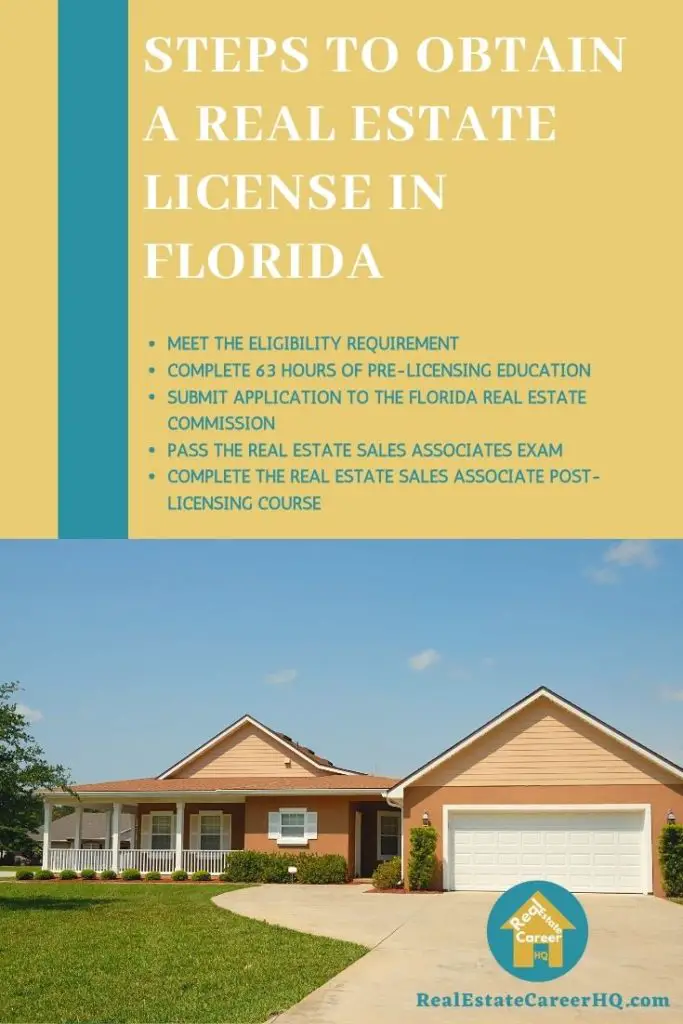

How How To Get A Real Estate License In Florida can Save You Time, Stress, and Money.

You enter into a contract without any intent really to acquire the home - What is cap rate real estate. The goal is to assign the contract to a buyer before the closing procedure. Instead of financial resources, a wholesaler requires to have outstanding networking and marketing skills. No license is required to wholesale genuine estate. Though, if a certified realty expert gets in into a contract, a lot of state laws require them to reveal this details with the purchaser or seller. The essential to purchasing wholesale is networking. You should establish yourself amongst fellow financiers and actively seek any chances. Numerous web platforms exist that specifically connect investors and sellers by area or area.

You can likewise look nationally on foreclosure and home auction sites. The counties you purchase likewise most likely list foreclosure auctions. Wholesale property listings may also exist on various classified websites such as craigslist. Remember that these homes move quick, and you'll need to have the financial methods or track record to develop a network where others send you deals first.

Wholesaling in property is among the more available methods you can try if you're Find more info simply beginning. You can possibly make profits quickly, without investing a lot of your own money or time. If that seems like an attractive deal to you, continue reading. We'll get into the wholesale real estate definition and how it works below. We'll likewise take a look at what a home wholesaler is, and the key things one needs to be successful because function. What is Wholesale Realty? Wholesale genuine estate is a property purchasing method where you shop a house straight from a house owner at a "wholesale" rate.

The distinction in the selling price and wholesale rate is your net earnings. Wholesale houses are usually distressed homes that are often not listed openly for sale. The homeowner wants to sell, but might not be prepared or doesn't have the funds to remodel your home to raise its value. In this circumstance, offering that house is a win for both the seller and the buyer. The house owner gets to offer at a fair price, while the purchaser gets a property for a deal, which they may remodel and cost a more considerable profit in the future. Advantages of Wholesaling Houses Wholesale realty is a fantastic method to enter real estate without potentially spending a single cent of your own money.

The deal occurs in between the house owner and investor, however the wholesaler still gets a share in the earnings. You might also get considerable profits faster with wholesale realty, Homepage presuming you have an all set buyer. It is not https://knoxxzfv.bloggersdelight.dk/2022/07/13/more-about-how-to-get-a-real-estate-license-in-ca/ unusual for financiers to earn a revenue quickly after they sell. However most of all, wholesaling residential or commercial property is an exceptional method for newbies to get their feet damp in genuine estate without risking much, if any, of their own money. A lot of the strategies and processes in wholesaling from marketing to negotiating are the exact same ones you'll take on as a real estate agent.